The Only Guide to Stonewell Bookkeeping

See This Report on Stonewell Bookkeeping

Table of ContentsHow Stonewell Bookkeeping can Save You Time, Stress, and Money.The Greatest Guide To Stonewell BookkeepingSome Known Details About Stonewell Bookkeeping Unknown Facts About Stonewell BookkeepingHow Stonewell Bookkeeping can Save You Time, Stress, and Money.

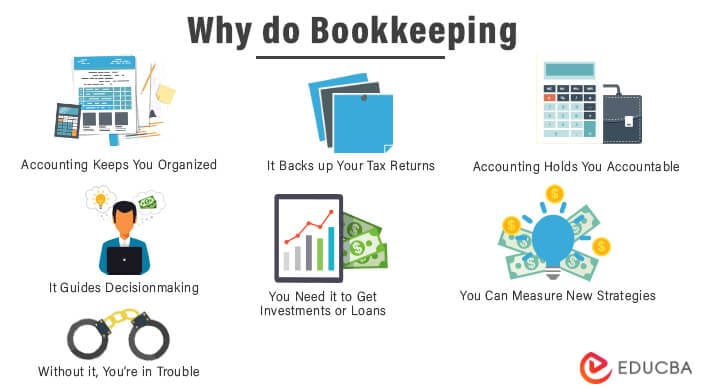

Rather of undergoing a filing closet of different documents, invoices, and receipts, you can provide in-depth documents to your accountant. Consequently, you and your accounting professional can conserve time. As an added benefit, you may even be able to recognize prospective tax write-offs. After utilizing your audit to file your taxes, the IRS might choose to execute an audit.

That funding can be available in the kind of proprietor's equity, gives, business loans, and investors. Financiers require to have a good idea of your organization before spending. If you don't have accounting records, capitalists can not figure out the success or failing of your business. They require updated, precise information. And, that details needs to be conveniently accessible.

Some Of Stonewell Bookkeeping

This is not meant as lawful recommendations; for more details, please click below..

We answered, "well, in order to know how much you require to be paying, we require to recognize just how much you're making. What is your internet revenue? "Well, I have $179,000 in my account, so I guess my net revenue (revenues much less expenditures) is $18K".

Some Of Stonewell Bookkeeping

While it can be that they have $18K in the account (and even that could not hold true), your balance in the bank does not necessarily determine your earnings. If a person obtained a give or a lending, those funds are ruled out earnings. And they would certainly not work into your revenue declaration in determining your earnings.

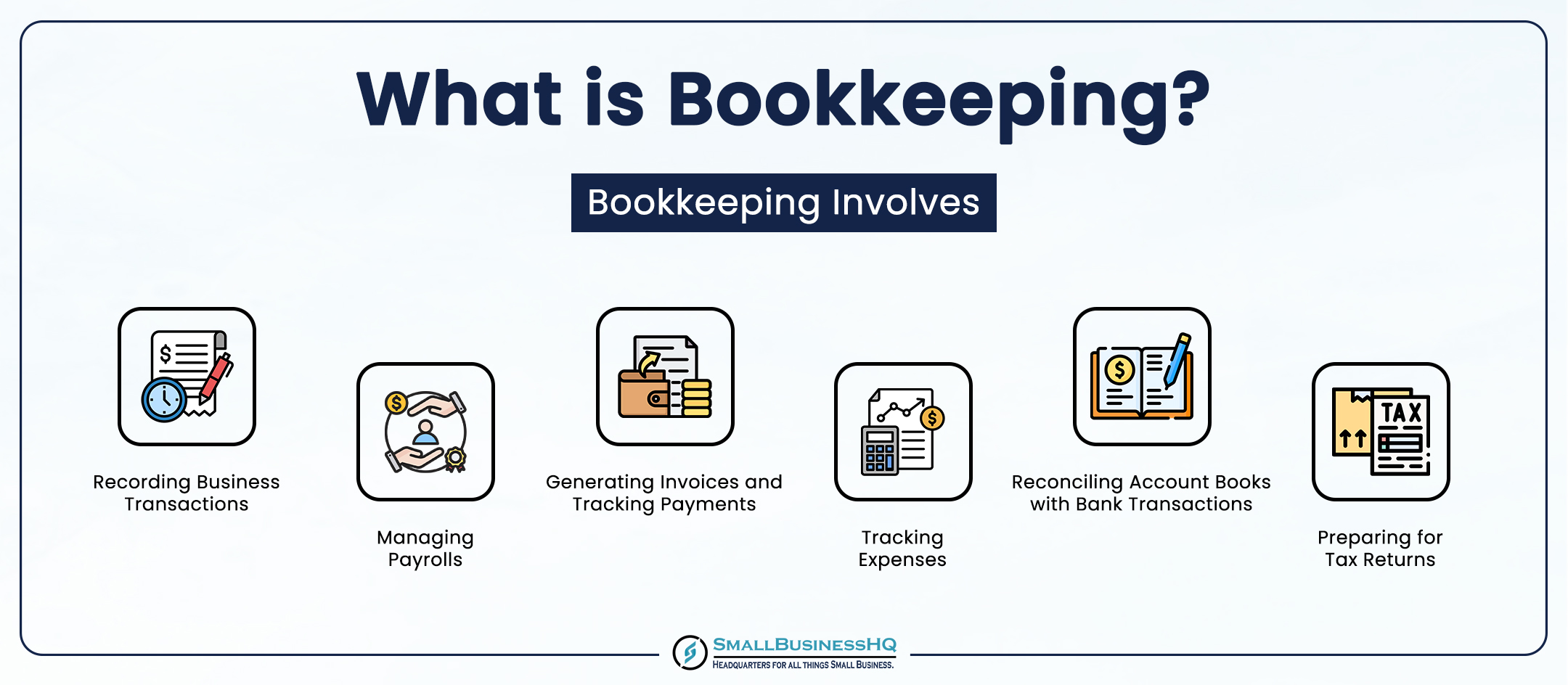

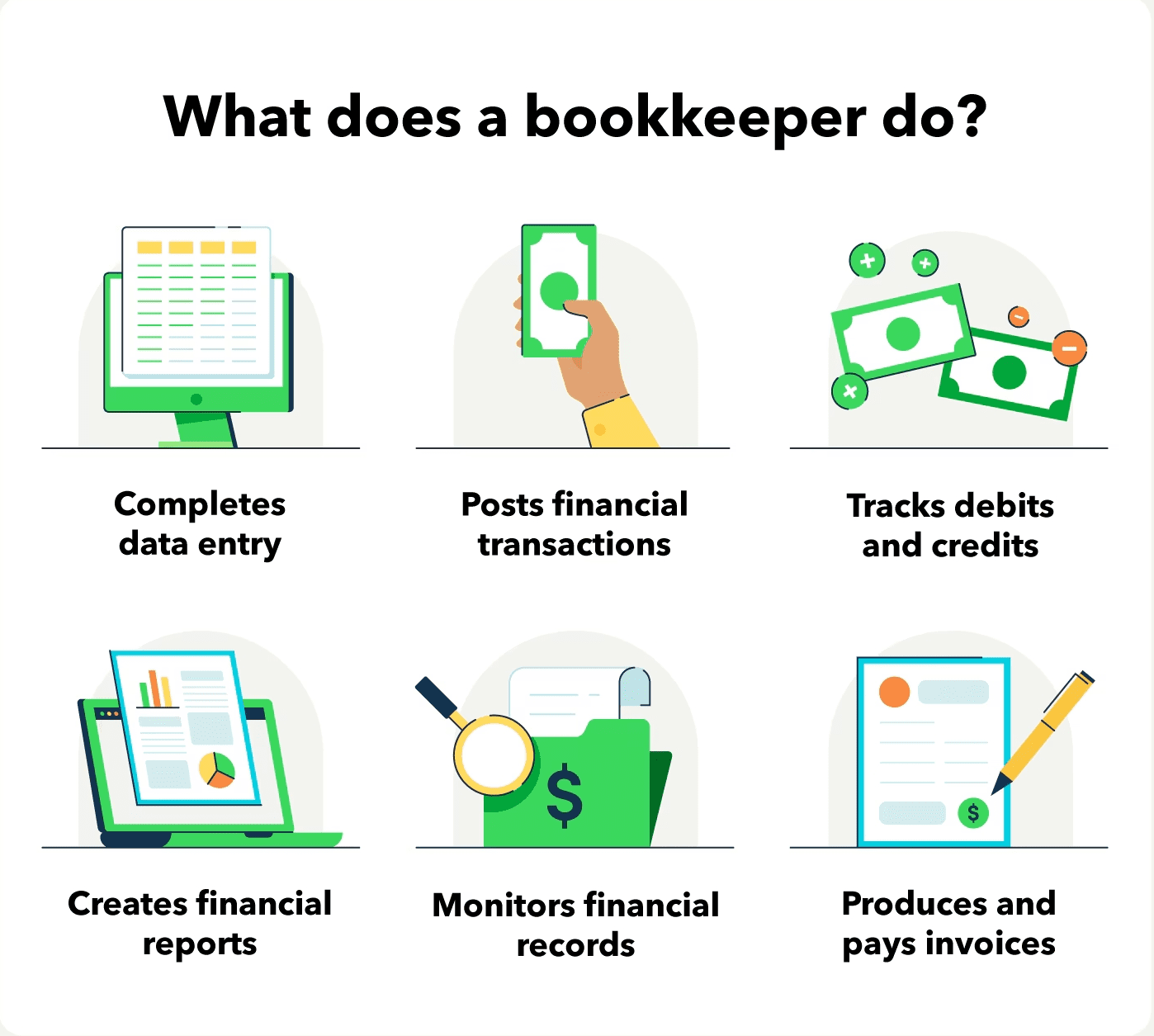

Several points that you think are expenses and deductions remain in fact neither. An appropriate set of publications, and an outsourced accountant that can properly classify those deals, will certainly aid you recognize what your business is really making. Accounting is the procedure of recording, categorizing, and organizing a business's monetary purchases and tax obligation filings.

A successful service calls for help from professionals. With realistic goals and a competent accountant, you can conveniently attend to challenges and keep those worries at bay. We devote our energy to guaranteeing you have a strong financial structure for growth.

Our Stonewell Bookkeeping Diaries

Accurate bookkeeping is the backbone of great monetary management in any kind of service. It assists track earnings and expenses, ensuring every transaction is tape-recorded properly. With excellent bookkeeping, services can make much better choices due to the fact that clear economic records offer useful data that can lead method and enhance earnings. This details is key for long-lasting preparation and forecasting.

Accurate financial declarations build depend on with loan providers and capitalists, enhancing your possibilities of getting the resources you need to expand., businesses should frequently integrate their accounts.

A bookkeeper will go across financial institution statements with internal documents at the very least once a month to locate errors or variances. Called bank reconciliation, this procedure ensures that the financial documents of the business suit those of the bank.

Money Circulation look at this website Declarations Tracks cash movement in and out of the business. These records assist service owners comprehend their monetary position and make informed decisions.

Not known Facts About Stonewell Bookkeeping

While this is cost-efficient, it can be time-consuming and vulnerable to errors. Tools like copyright, Xero, and FreshBooks permit business owners to automate accounting jobs. These programs aid with invoicing, financial institution settlement, and economic reporting.